Welcome to the amazing world of mobile banking, where depositing a check is as simple as clicking a button on your smartphone. It’s hard to imagine a time when banking required physical visits to branches and waiting in long queues. Today, with mobile banking apps, you are the bank. You can literally write a check to yourself for mobile deposit, a process so simple that you might wonder why you haven’t been doing it all along.

Understanding Mobile Deposits

Mobile deposits are as straightforward as they sound. Essentially, it involves depositing a check into your bank account using your bank’s mobile app. Yes, that’s right! No more trips to the bank, no more deposit slips, and no more waiting in line. All you need is a smartphone, a steady hand, and the right app. Here’s how it works:

- Download your bank’s mobile app: Every reputable bank has a dedicated mobile app. These apps can be downloaded from your phone’s app store (either Google Play Store or Apple’s App Store).

- Register: If you’re not already registered, you’ll need to create an account. Usually, this process involves providing some basic personal information.

- Prepare the check: Endorse the back of the check and write “for mobile deposit only” below your signature. This step is a precautionary measure that prevents the check from being cashed if it falls into the wrong hands.

- Photograph the check: Using the app, take pictures of both the front and back of the check. Ensure that all the details, such as the amount and payee name, are clearly visible.

- Deposit the check: Once the images are uploaded, enter the amount and select the account into which you want to deposit the check. Then, submit the deposit.

Just like that, your check is deposited. Now, there’s a grace period before the funds are available, usually between one to two business days, but it’s far more convenient than a trip to the bank!

Why and How to Write a Check to Yourself for Mobile Deposit

You might be wondering, why would I need to write a check to myself? Well, there are several scenarios where this can come in handy.

- You may want to move funds between accounts at different banks

- You’ve received a cash payment and you want to deposit it into your account without having to visit the bank.

Whatever the reason, it’s perfectly legal and incredibly easy.

Writing a check to yourself is no different than writing one to someone else. Just follow these simple steps:

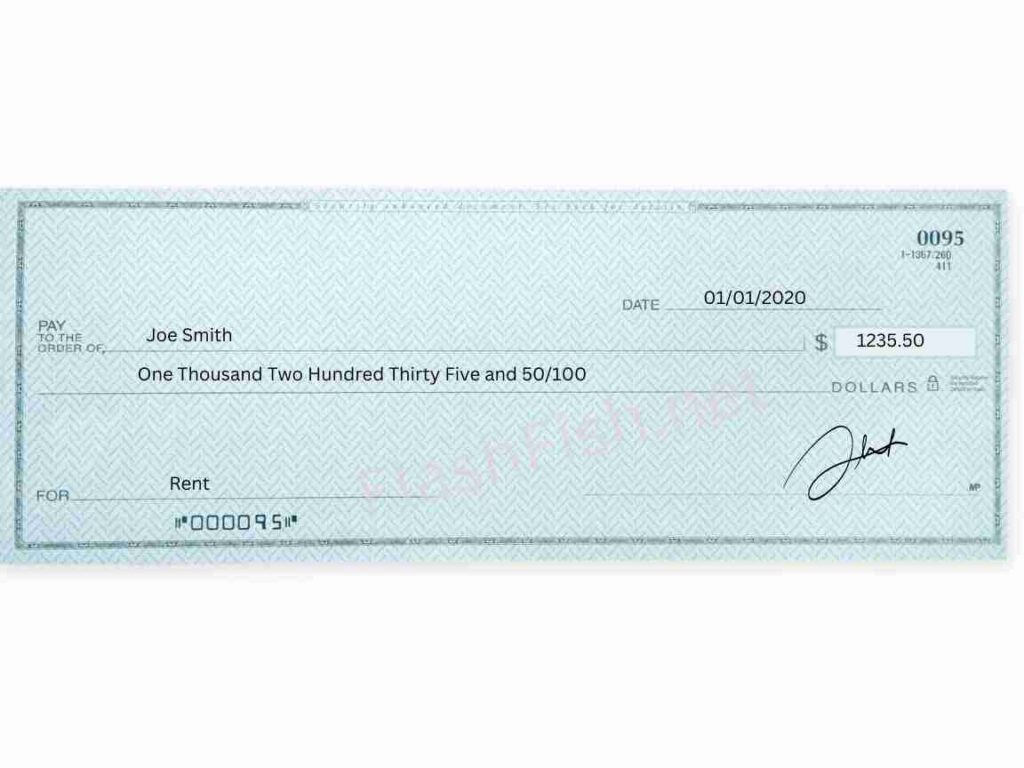

- Date: In the top right corner of the check, you will see a line for the date. Write the current date here. This helps both you and your bank keep track of the check.

- Payee: On the line labeled “Pay to the order of,” write your own name. This makes you the recipient of the funds.

- Amount in Numeric Form: In the box right after the payee line, write the amount of the check in numeric form. For example, if you’re writing a check for fifty dollars, you would write “50.00.”

- Amount in Word Form: On the line beneath the payee line, write out the amount of the check in words. Using the previous example, you would write “Fifty and 00/100.” Make sure to draw a line to the end after the amount is written out to prevent anyone from altering the amount.

- Memo (Optional): The memo line at the bottom left of the check is optional, but it can be helpful for record-keeping purposes. You could write “Personal Deposit” or any other note that will help you remember why you wrote the check.

- Signature: Sign the check on the line in the bottom right corner. Your signature is necessary for the check to be valid.

- Endorse the back of the check and write “for mobile deposit only” below your signature.

That’s it! You’ve just written a check to yourself. Now you can deposit it using your mobile banking app.

Tips to Successfully Capture Your Check for Mobile Deposit

While depositing a check via your mobile banking app is a cinch, getting the right photo of your check is the key to a smooth transaction.

Here’s a list of tips to ensure you get the best shot:

- Good Lighting: Always photograph your check in good lighting. Insufficient light may lead to a blurry picture, causing the app to reject your deposit.

- Background Contrast: Place the check on a dark background if it’s light, and vice versa. The contrasting color helps the app recognize the check’s borders.

- Keep it Steady: Hold your phone steady or use a stand or a flat surface for support to avoid a blurry image.

- Check Alignment: Align your check with the guidelines on your phone screen to ensure the app captures all the necessary details.

- Check Quality: Make sure all details on the check are clear and legible before submitting. You want the app, and ultimately the bank, to clearly read the amount, account, and routing numbers.

Protecting Yourself during Check Deposit with Mobile

A big part of self-banking is self-security. While mobile banking has undoubtedly made life easier, it has also exposed us to new risks. In the wrong hands, your banking information can be misused, leading to financial loss and a host of other problems. The good news is that there are several steps you can take to protect yourself:

- Secure Your Device: Ensure that your device is protected with a strong passcode, fingerprint, or facial recognition system.

- Public Wi-Fi is a No-No: Avoid making transactions when connected to public Wi-Fi networks. These networks are often not secure and can be easily hacked.

- Watch for Phishing Scams: Always be on the alert for phishing scams. Never disclose your banking details over email or text message.

- Review Your Transactions Regularly: Frequently review your account transactions. Quick detection of any irregularities can prevent further damage.

While mobile banking gives us the freedom to fly high in terms of convenience, it’s crucial to be mindful of the potential dangers to avoid a similar fate. Always place your security first, and the skies will remain open for a smooth banking flight.

Common Issues to Avoid when you Write a Check for Mobile Deposit

The ease and convenience of mobile deposits come with its own set of challenges. One memorable instance involved a sizable check getting rejected repeatedly due to poor image quality. It turned out that the bank’s app wasn’t compatible with my then-older model phone. Switching to a newer device solved the issue.

Let’s look at some common pitfalls and how you can steer clear of them:

- Incompatible Devices: As I found out, not all devices work well with all banking apps. If you’re facing frequent issues, consider using a different device.

- Deposit Limits: Most banks have daily and monthly mobile deposit limits. Check these limits to avoid transaction rejections.

- Check Holds: Depending upon the amount and type of check, your bank might place a hold on your deposit. If immediate access to your funds is necessary, consider other deposit options.

- Incorrect Endorsement: Failure to correctly endorse the check can lead to deposit rejection. Always follow the endorsement instructions provided by your bank.

- Expired Checks: Checks typically become void after 180 days. Attempting to deposit an expired check will result in rejection.

Mobile Banking Advanced Features and Benefits

Beyond the basic features, mobile banking apps offer an array of advanced functionalities that can streamline your financial life. From setting up automatic payments and transferring funds to receiving notifications for low balance and paying friends, the possibilities are virtually endless.

- Instant Deposits: Some banks make the deposit available instantly.

- Custom Alerts: Set up alerts for low balance, check deposits, withdrawals, and more.

- Check Status: Track the status of your deposited checks and view images of cleared checks.

Wrapping Up

In this digital era, mobile banking has swiftly turned from a luxury to a necessity. The ability to write a check to yourself for mobile deposit is just one example of the way it has revolutionized our financial lives. It’s safe, convenient, environmentally friendly, and empowering.

The ability to bank on our own terms, in our own time, and from any place is nothing short of revolutionary. It’s a power that we hold in our own hands, quite literally. And with this power comes the responsibility to use it wisely, securely, and effectively.

So, are you ready to write that first check to yourself? Go ahead, give it a shot.

To further hone your financial acumen, consider exploring these related articles, which delve into various investment strategies and financial independence concepts:

- Dream Retirement: A Financial Independence Retire Early (FIRE) Perspective

- How Many Pay Periods in a Year : Solve the Pay Period Conundrum