Automatic Investment Plans (AIP) and Systematic Investment Plans (SIP) are two popular strategies that have gained traction in recent years. The world of investment can be a confusing and complex landscape, with countless strategies and techniques promising to maximize returns and minimize risk. In this article, we’ll break down the key differences between SIP and AIP, and explore their respective benefits and drawbacks. Along the way, we’ll delve into relevant technical details required to help you make an informed decision on which strategy might be best for your investment goals.

Table of Contents

The Basics of SIP and AIP

Systematic Investment Plan (SIP)

A Systematic Investment Plan, or SIP, is an investment strategy where an individual invests a fixed amount of money at regular intervals (usually monthly) in a specific financial instrument, such as mutual funds, stocks, or bonds. This approach is designed to mitigate the impact of market fluctuations by spreading out the investment over time.

Automatic Investment Plan (AIP)

An Automatic Investment Plan, or AIP, is a digital investment strategy that leverages algorithms and artificial intelligence to automatically invest your money in a diversified portfolio of financial instruments. AIP platforms, often referred to as “robo-advisors,” analyze an investor’s risk tolerance, financial goals, and time horizon to create a customized investment portfolio tailored to their needs.

Key Differences between SIP and AIP

| Features | Systematic Investment Plan (SIP) | Automatic Investment Plan (AIP) |

|---|---|---|

| Investment Approach | Manual, disciplined approach | Algorithm-driven, automated |

| Decision-Making | Investor-driven | Robo-advisor-driven |

| Diversification | Limited by investor knowledge | Broad, based on algorithms |

| Cost | Lower fees, transaction costs | Higher fees for robo-advisory |

The Pros and Cons of Systematic Investment Plan (SIP)

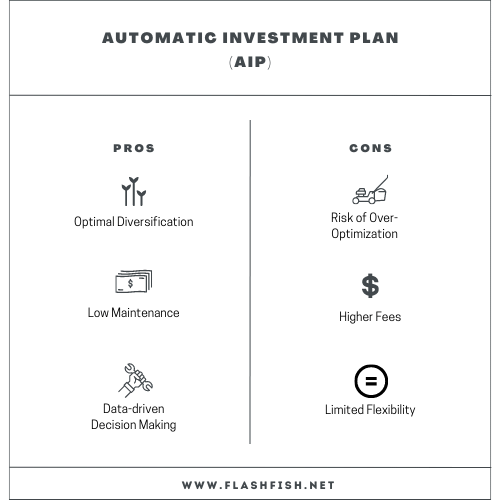

The Pros and Cons of Automatic Investment Plan (AIP)

Technical Details and Considerations

Systematic Investment Plan (SIP)

- Exit Load: Some mutual funds charge an exit load if you withdraw your investment before a specified period (usually one year). This can impact your returns if you need to access your funds early.

- Expense Ratio: Mutual funds charge an annual fee called the expense ratio, which covers the fund’s operating expenses. A higher expense ratio can eat into your returns over time.

Automatic Investment Plan (AIP)

- Tax Considerations: AIP platforms may trigger taxable events when rebalancing your portfolio. Consult a tax professional to understand the implications.

- Algorithm Reliability: Robo-advisors rely on algorithms to make investment decisions. While generally reliable, they are not immune to errors or biases. Periodic reviews of your portfolio can help identify any issues.

Automatic Investment Plan (AIP) Platforms (Robo-Advisors):

- Betterment: Betterment is a popular robo-advisor platform in the US market. It offers personalized, automated investment portfolios based on an investor’s risk tolerance, financial goals, and time horizon. Betterment handles the ongoing management and rebalancing of your portfolio.

- Wealthfront: Wealthfront is another leading robo-advisor platform, providing investors with customized, diversified portfolios that are automatically managed and rebalanced. They use advanced algorithms and data-driven decision-making to optimize returns and minimize risk.

- Ellevest: Ellevest is a robo-advisor platform designed specifically for women, aiming to close the gender investing gap. It offers personalized investment portfolios tailored to an investor’s financial goals and risk tolerance, with automatic management and rebalancing.

Systematic Investment Plan (SIP) Platforms:

- Vanguard: Vanguard is a well-known investment management company offering a wide range of low-cost mutual funds and ETFs. They allow investors to set up automatic investments (akin to SIPs) in these funds on a regular basis, making it easy to maintain a disciplined investment approach.

- Fidelity: Another prominent investment management firm, Fidelity offers a vast selection of mutual funds, ETFs, and other investment products. Investors can set up automatic investments in Fidelity’s funds on a scheduled basis, similar to an SIP.

Fees comparison:

Here’s a table for fees and costs associated with SIP and AIP platforms. Please note that these are generalized numbers, and the actual fees and costs may vary depending on the specific platform and investment options you choose.

| Fee/Cost Type | SIP (Traditional Brokerage) | AIP (Robo-Advisor) |

|---|---|---|

| Management Fee | 0.25% – 1.5% | 0.25% – 0.5% |

| Expense Ratio (Mutual Funds) | 0.05% – 2% | 0.05% – 1% |

| Expense Ratio (ETFs) | 0.03% – 1% | 0.03% – 1% |

| Trading Commissions | $0 – $10 per trade | Usually $0 |

| Account Maintenance Fee | $0 – $50 per year | $0 – $100 per year |

| Account Minimum | $0 – $3,000 | $0 – $5,000 |

Conclusion

Both SIP and AIP offer distinct advantages and disadvantages for investors. SIPs promote a disciplined approach, while AIP platforms utilize data-driven decision-making and offer optimal diversification. Ultimately, the best strategy for you will depend on your individual investment goals, risk tolerance, and personal preferences. By considering the information presented in this blog post, you can make a more informed decision on which investment strategy is right for you.

[…] plan offers a variety of investment options, including Age-based portfolios and Individual /Static […]

[…] Automatic Investment Plan (AIP): Comparison of Investment Strategies SIP vs AIP […]

[…] Automatic Investment Plan (AIP): Comparison of Investment Strategies SIP vs AIP […]

[…] and goals. Alternatives to consider include Coverdell ESAs, UTMA/UGMA accounts, Roth IRAs, Automatic Investment Plans (AIPs), and high-yield savings accounts. It’s essential to evaluate each option’s pros and […]

[…] advancements: New financial technologies, such as robo-advisors and mobile apps, can simplify the process of managing and optimizing your 401(k) […]

[…] are automated investment platforms that provide algorithm-driven financial planning services with minimal human intervention. They can […]

[…] Automatic Investment Plan (AIP): Comparison of Investment Strategies SIP vs AIP […]

[…] robo-advisor also referred as Automatic Investment Planning is a digital platform that uses algorithms and artificial intelligence to provide investment advice […]

[…] Making Every Penny Count: A Comparison of Investment Strategies – SIP vs AIP […]

This article offers valuable insights that I haven’t found elsewhere. Thank you for the fresh ideas!