In our digital age, to write a check to yourself might seem like an old-school concept, especially when instant money transfers via apps and online platforms are the norm. But it’s a financial maneuver that’s as relevant today as it was in the days of paper ledgers and inky pens.

In this article we will talk money—specifically, how it moves from one place to another. Have you ever wondered, “Can I write myself a check?” or “Where can I cash a check written to myself?” If so, you’re in the right place!

Table of Contents

What is a Personal Check?

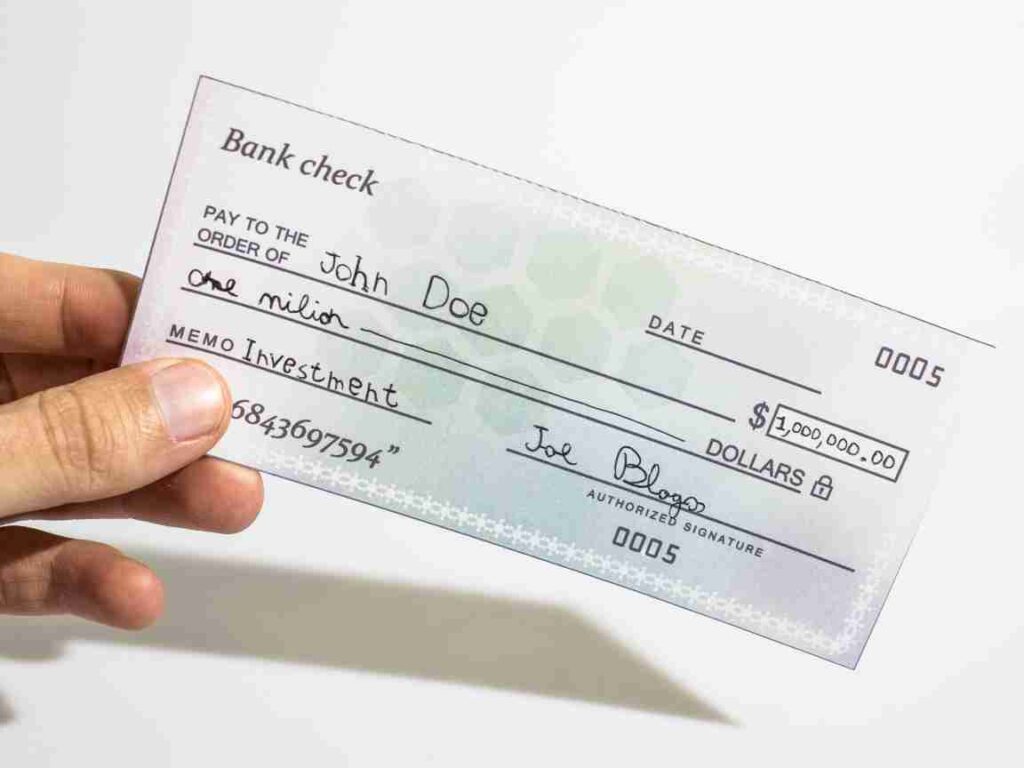

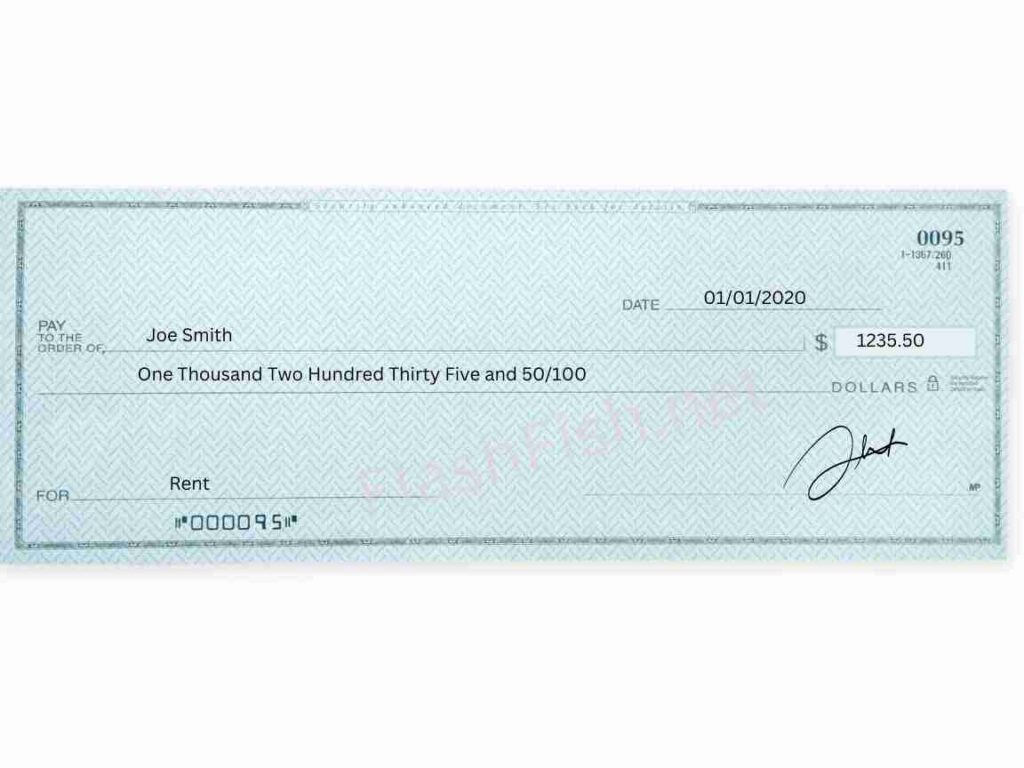

Before we dive into the how-to, let’s first understand what a personal check is. A personal check is a slip of paper issued by a bank that allows you to make payments from your bank account to that of another person or business. It’s like a promise note—when you write a check, you’re essentially saying, “I promise to pay this amount to this person or entity.”

Can I Write Myself a Personal Check?

Absolutely, yes! Writing a check to yourself is a simple and efficient way to move money between accounts, be it from savings to checking, or vice versa. This method works if you have accounts in different banks or if you want to withdraw cash from your own account. Maybe you’re trying to build an emergency fund at a new bank, or perhaps you’re keen on taking advantage of a higher interest rate at another institution. In these situations, writing a check to yourself can be a practical option.

In the era of Venmo and PayPal, writing a check seems as outdated as using a VHS tape to record Friends reruns. But believe me, there are still times when those quaint little paper squares can come in handy.

5 Steps to Write a Check to Yourself for Cash

Writing a check to yourself is no different from writing a check to anyone else. Here are the steps you need to follow:

- Date: On the top right corner, write the current date.

- Payee: On the line labeled ‘Pay to the Order of’, write your name.

- Amount in numeric form: In the box on the right, write the amount you want to cash, in numeric form.

- Amount in words: On the line under the payee, write the amount in words.

- Signature: On the line in the bottom right corner, sign your name.

Memo (optional): On the line in the bottom left corner, you can write a note to yourself or “For Deposit Only” if you’re depositing the check.

When you’re ready to deposit the check, endorse it by signing your name on the back. Be careful not to do this too early if you’re worried about losing the check. Finally, you can cash it at your bank or deposit it into your account.

Where Can I Cash a Check Written to Myself?

That’s the next logical question, right? Once you’ve written the check, where can you cash it? The simplest place is your bank or the bank that issued the check. But there are other options:

- Your Bank or Credit Union: Most banks offer check cashing services, and for their customers, these services are often free.

- The Bank that Issued the Check: If the check was issued by another bank, you can take it to a branch of that bank to cash it.

- Retail Stores: Some big box stores and grocery stores like Walmart offer check cashing services, often for a small fee.

- Check Cashing Stores: These are available, but they usually charge a higher fee, so they should be your last resort.

- ATMs: If you have a debit card, you may be able to cash the check at an ATM. Check with your bank for any potential fees and restrictions.

- Mobile Deposits: Many banks now offer mobile deposit through their apps, where you can deposit your check by taking a photo of it.

Remember, fees and restrictions can vary, so it’s always best to do a little homework before deciding where to cash your check.

Is Writing a Check to Yourself Safe?

Writing a check to yourself is generally safe, as long as you keep the check secure until you can deposit or cash it. However, it’s worth noting that checks can bounce if there aren’t sufficient funds in the account. If you’re unsure about the balance, it’s best to verify before writing the check.

When Is Writing a Check to Yourself the Best Option?

Now, I’m not saying you should always write a check to yourself when you need to move money around. It’s not the quickest method, and it does involve a bit of paper shuffling. But, it can be helpful in certain situations:

- When Your Banks Don’t Offer an Easy Transfer System: Not all banks make it easy to transfer money, especially if you’re dealing with different institutions. In these cases, a check can be a simple solution.

- When You’re Not Comfortable with Digital Transactions: If you’re wary of digital banking or just prefer doing things the old-fashioned way, checks offer a tangible, physical method of transferring money.

- When You Need a Paper Trail: Checks provide a clear paper trail, which can be useful for record-keeping, especially for business transactions or large personal transfers.

Common Misconceptions

Some financial experts argue that checks are outdated and less secure compared to digital transfers. They note that checks can be lost, stolen, or altered. However, others highlight the convenience of checks, especially for those who prefer physical transactions or lack access to digital banking.

A common misconception is that writing a check to yourself is a form of illegal “check kiting.” This is not true—check kiting involves writing checks without the funds to cover them, with the intent to defraud the bank. As long as you have sufficient funds, writing a check to yourself is completely legal and acceptable.

5 Faster Alternatives to Writing a Check to Yourself

While writing a check to yourself is a straightforward process, it’s not the only way to transfer money. If you’re a fan of Star Trek like me, and you love the idea of instantaneous teleportation, these digital alternatives might be more up your alley:

- Mobile Check Deposit is another easy way where you can still write check to yourself but save a trip to bank by depositing the check using the mobile banking app.

- Bank Transfers: You can transfer money directly from one bank account to another. This can usually be done online or through a mobile app.

- Wire Transfers: Wire transfers are faster than traditional bank transfers, but they often come with a fee.

- Peer-to-Peer (P2P) Payment Apps: Apps like Venmo, Cash App, and Zelle allow you to send money directly to another person, often for free.

- PayPal: You can use PayPal to send money to friends and family or pay for goods and services.

- Cryptocurrency Transfers: If you’re into Bitcoin or other cryptocurrencies, you can use them to send and receive money.

Let’s break down some of the pros and cons of these alternatives:

| Method | Pros | Cons |

|---|---|---|

| Bank Transfers | Usually free, can set up recurring transfers | Can take several business days |

| Wire Transfers | Fast, secure | Usually comes with a fee |

| P2P Payment Apps | Fast, often free for personal use | Need to trust the other party, may have transfer limits |

| PayPal | Widely used, can pay for goods and services | Fees for business transactions, can take time to transfer to bank |

| Cryptocurrency | Fast, can be used internationally | Volatile, not universally accepted |

Conclusion

In summary, you can write a check to yourself to transfer money between accounts or to cash out. But remember, it’s just one of many options available to you. Whether you prefer the traditional method of checks or the convenience of digital apps, the choice depends on your comfort level, needs, and access to banking services.

Engage with us! Have you ever written a check to yourself? Do you prefer digital transactions? Let us know in the comments below and don’t forget to share this post with your friends who may find it useful.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a financial professional before making any major financial decisions.

As we’ve journeyed through the ins and outs of writing check, it’s clear that understanding the nuances of financial instruments is key to navigating life’s financial obligations. While we may not be able to anticipate every financial challenge, making savvy financial decisions early in life can provide a cushion for when we need it most.

To further hone your financial acumen, consider exploring these related articles, which delve into various investment strategies and financial independence concepts:

- How to Write Check Amount in Words with Cents

- Making Every Penny Count: A Comparison of Investment Strategies – SIP vs AIP

- Dream Retirement: A Financial Independence Retire Early (FIRE) Perspective

- How Many Pay Periods in a Year : Solve the Pay Period Conundrum

Frequently Asked Questions (FAQs)

Can I write a personal check to myself and cash it at Walmart?

Yes, you can! Walmart offers check-cashing services for a small fee. They accept pre-printed checks, payroll checks, government checks, tax checks, cashier’s checks, insurance settlement checks, 401(k) retirement disbursement checks, and MoneyGram money orders. Remember, you’ll need to provide a valid, government-issued photo ID to cash a check at Walmart.

What app will cash a check immediately?

There are several apps that offer immediate check cashing. These include Ingo Money, ACE Mobile Loads, and PayPal’s mobile app (although PayPal’s check-cashing feature may not be instantaneous). Keep in mind that these apps typically charge a fee for immediate check cashing, and there may be limits on the check amount.

Can you cash a check with insufficient funds?

If you write a check and there are insufficient funds in your account when the check is cashed or deposited, the check will bounce. This can result in fees from both your bank and the bank where the check was presented, and it could also negatively impact your credit score. Always make sure you have enough funds in your account to cover the check before you write it.

Do checks cash instantly at ATM?

Depositing a check at an ATM isn’t an immediate process. While you can deposit the check, it may take several business days for the funds to be available in your account. The exact timing can depend on your bank’s policies and the amount of the check. If you need the funds immediately, it may be better to cash the check at a teller or through a check-cashing service.

How can I verify a check instantly?

Verifying a check instantly can be a bit tricky. Some banks offer verification services, but they may only be able to confirm if there are currently sufficient funds in the account, not whether there will be when the check is cashed or deposited. There are also third-party services that offer check verification, but they typically charge a fee. Always be cautious when accepting checks, especially from unknown parties.