Vanguard 529 Plan provides for Education Savings Account – in this article we look at how it works, what the benefits are, Vanguard 529 fees, and how you can compare with other similar plans in the market. Essentially help you answer – Is Vanguard good for 529 plans ?

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to help families save for future education expenses. These expenses can include tuition, fees, room and board, books, and other related expenses. The plan is named after section 529 of the Internal Revenue Code, which outlines the rules and regulations governing these types of plans. You can find more details on this in over comprehensive guide on 529 Plan.

Vanguard 529 Plan Review

The Vanguard 529 Plan is a 529 college savings plan offered by The Vanguard Group, one of the world’s largest investment management companies. The plan is administered by the State of Nevada but is available to residents of any state.

Eligibility Requirements

- An U.S. citizen or a resident alien can open a Vanguard 529 plan for any beneficiary.

- No age restrictions or income limitations for beneficiary.

- Residency: Some state specific plans offered by Vanguard require either the account owner or beneficiary to be a resident of the state to qualify for certain benefits, such as state tax deductions or matching contributions.

Vanguard 529 Funds Investment Options:

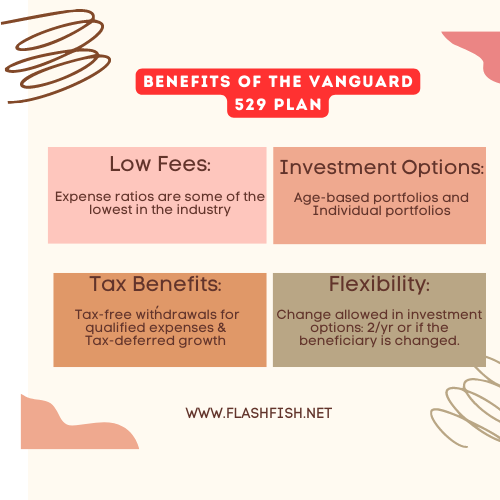

The plan offers a variety of investment options, including Age-based portfolios and Individual /Static portfolios.

Target Enrollment Portfolios: Invest in a portfolio based on the year you expect your child to start school—from kindergarten through graduate. Target date funds portfolio will automatically adjust its allocation to account for risk based on your student’s expected year of enrollment.

Individual/ Static Portfolios: Self-Service model, Allows account holders to customize their investment mix based on their personal preferences and risk tolerance.

Target Enrollment (Age-based) Portfolios offered by Vanguard 529 Plan:

In a target enrollment (age-based) portfolio offered by Vanguard 529 Plan, the asset allocation changes automatically over the years as the beneficiary gets closer to college age.

In general, when the beneficiary is young, the portfolio is more heavily invested in equities and has a higher risk tolerance. As the beneficiary approaches college age, the portfolio gradually shifts to a more conservative allocation, with a higher allocation to fixed-income investments to help protect against market volatility.

The asset allocation is typically rebalanced automatically by the plan manager, which helps to ensure that the portfolio stays in line with the beneficiary’s changing investment needs and goals.

| Portfolio | Child Age Range | Asset Allocation |

|---|---|---|

| Aggressive Growth | Under 9 years old | In Equities: High In Fixed income: Low |

| Moderate Growth | 9-12 years old | In Equities: Balanced In Fixed income: Balanced |

| Conservative | Over 12 years old | In Equities: Low In Fixed income: Low |

Individual / Static fund portfolios offered by Vanguard 529 Plan:

| Vanguard Fund | Investment Type | Investment Strategy |

|---|---|---|

| Vanguard Total Stock Market Index Fund | U.S. Stocks | Broad range of U.S. stocks |

| Vanguard Total International Stock Index Fund | International Stocks | Broad range of international stocks |

| Vanguard 500 Index Portfolio | Large Blend | Broad range of U.S. bonds |

| Vanguard Total International Bond Index Fund | International Bonds | Broad range of international bonds |

| Vanguard Short-Term Investment-Grade Fund | U.S. Bonds | Short-term, high-quality U.S. bonds |

| Vanguard Inflation-Protected Securities Fund | U.S. Bonds | U.S. Treasury inflation-protected securities |

Vanguard 529 Fees:

Under the Vanguard 529 Plan, you can open multiple portfolios for a single beneficiary, each with a different investment strategy and asset allocation. Additionally, there may be tax and administrative implications to consider when opening multiple portfolios for the same beneficiary.

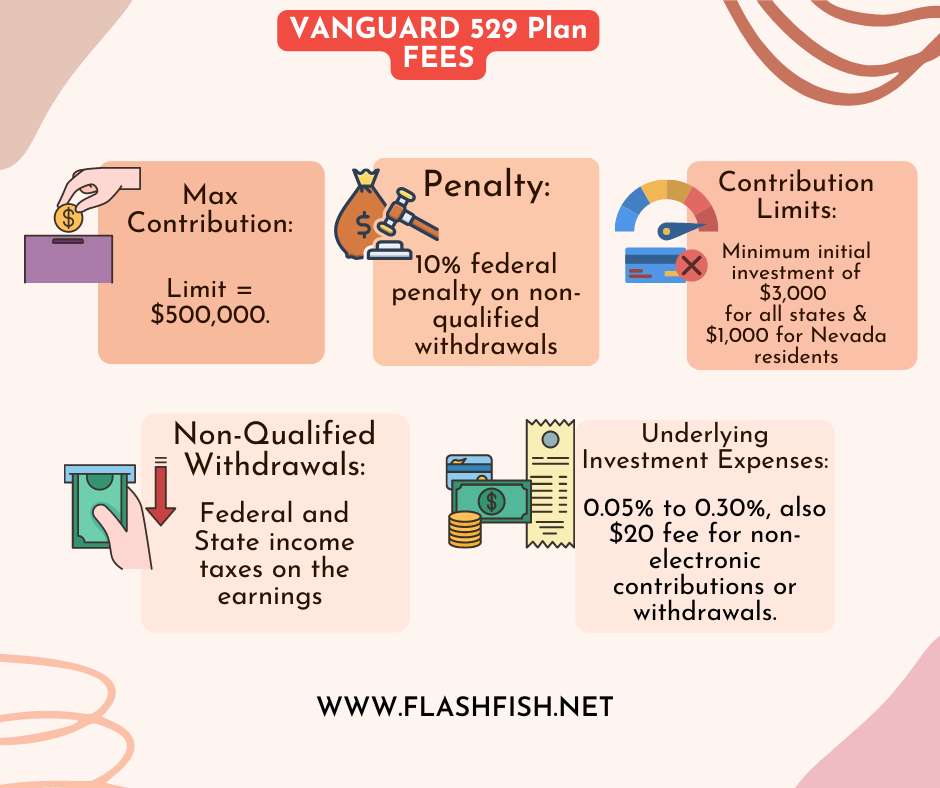

Maximum Yearly Contribution allowed up to $500,000, with 10% federal penalty for on non-qualified withdrawals and income tax charged for interest earnings.

After looking at the fees some even wonder are 529 plan worth it ? Every kind of financial investments have fees involved and these goes towards providing added benefits that come with it.

How to Open Vanguard 529 Plan Account:

- Visit the Vanguard 529 login website and follow the instructions to open an account online.

- You will need to provide personal information, such as your name, address, Social Security number, and date of birth, as well as information about the beneficiary of the plan.

- You will also need to select the investment options you want for your plan.

- Once your account is open, you can select source of contributions and start making auto deposits and manage your investments.

Comparison Between Vanguard 529 Plan and other equally Best 529 Plans:

| Plan Name | Minimum Initial Investment | Vanguard 529 Plan Fees |

|---|---|---|

| Vanguard 529 Plan | $3,000 ($1000 for Nevada residents) | Enrollment fee and Account maintenance: NIL Underlying investment expenses range from 0.05% to 0.30%. |

| Fidelity 529 Plan | $0-$2500 (Varies by plan) | Enrollment fee and Account maintenance: NIL Underlying investment expenses range from 0.08% to 0.63%. |

| Schwab 529 Plan | $25-$3000 (Varies by plan) | Enrollment fee and Account maintenance: NIL Underlying investment expenses range from 0.20% to 0.75%. |

| New York’s 529 College Savings Program | $25-$1000 (Varies by plan) | Enrollment fee: $0 to $50. Annual account maintenance fee: $0 to $20. Underlying investment expenses range from 0.16% to 0.78%. |

As you can see Vanguard 529 is a great option for someone looking to get started with planning and safeguarding your kids future. With no management fees and low expense for Vanguard 529 fees makes this one of the most popular 529 plan.

[…] Vanguard 529 Plan : Ultimate Education Savings Tool […]

[…] Vanguard 529 Plan : Ultimate Education Savings Tool […]

[…] Vanguard 529 Plan is one such popular 529 college savings plan with low fees and expense ratios. […]

[…] Vanguard 529 Plan : Ultimate Education Savings Tool […]