When it comes to investing in the U.S. stock market, Vanguard’s Total Stock Market funds, Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) and Vanguard Total Stock Market Index Fund Investor Shares (VTSMX), are often the go-to choices for many investors. In this article, we’ll delve into a detailed comparison of VTSAX vs VTSMX, including a technical analysis and an examination of the underlying stocks for these Vanguard Index Funds.

A Brief Introduction to VTSAX and VTSMX

Both VTSAX and VTSMX are designed to provide investors with broad exposure to the U.S. stock market by tracking the performance of the CRSP US Total Market Index. This index represents virtually the entire U.S. equity market, including large-cap, mid-cap, small-cap, and micro-cap stocks. These funds have become increasingly popular in recent years, with many investors seeing them as the “S&P 500 of the 21st century” due to their comprehensive market coverage.

Technical Differences Between VTSAX vs VTSMX

While both VTSAX and VTSMX share the same investment objective, there are some notable technical differences:

| Attribute | VTSAX | VTSMX |

|---|---|---|

| Share Class | Admiral Shares | Investor Shares |

| Minimum Investment | $3,000 | $1,000 |

| Expense Ratio | 0.04% | 0.14% |

- Share Class: VTSAX is an Admiral Shares fund, while VTSMX is an Investor Shares fund. Admiral Shares typically have lower expense ratios compared to Investor Shares, which can result in cost savings for investors.

- Minimum Investment: VTSAX requires a minimum investment of $3,000, while VTSMX has a lower minimum investment requirement of $1,000. This makes VTSMX more accessible for smaller investors or those just starting out.

- Expense Ratio: VTSAX has a lower expense ratio of 0.04%, compared to VTSMX’s expense ratio of 0.14%. Lower fees can have a significant impact on long-term investment returns.

Underlying Stocks: VTSAX vs VTSMX

Both VTSAX and VTSMX invest in the same underlying stocks, as they track the CRSP US Total Market Index. Here are some key aspects of the underlying stocks held in these funds:

- Diversification: The funds offer broad diversification across various sectors, including technology, healthcare, financials, and consumer goods. This diversification is akin to a “market buffet,” providing a wide array of investment options for investors.

- Top Holdings: Some of the largest and most well-known U.S. companies are among the top holdings in both VTSAX and VTSMX. These market heavyweights” include Apple Inc. (AAPL), Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL, GOOG), and Facebook Inc. (FB). These companies often find their way into pop culture and media, becoming household names due to their ubiquitous products and services.

- Market Capitalization: The underlying stocks in both funds span the entire range of market capitalization, from mega-cap companies like Apple and Microsoft to small- and micro-cap stocks. This comprehensive market coverage is like having a front-row seat to the growth potential of companies at various stages of development.

- Dividend Stocks: Both VTSAX and VTSMX hold dividend-paying and non-dividend-paying stocks. Dividend-paying stocks can provide investors with income and potential capital appreciation, while non-dividend-paying stocks may offer greater growth potential.

Performance Comparison VTSAX vs VTSMX

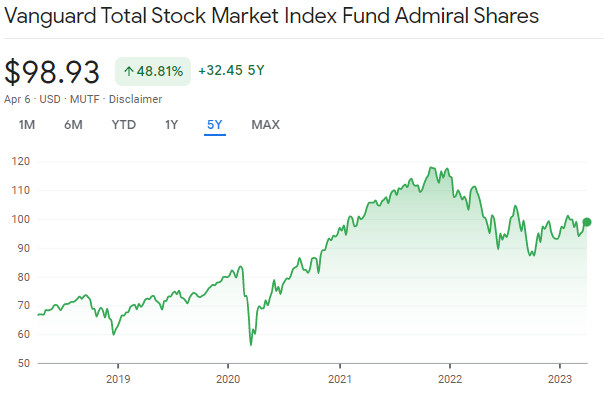

When comparing the performance of VTSAX vs VTSMX, it’s essential to keep in mind that their returns will be very similar due to their identical investment objectives and underlying stocks. However, the lower expense ratio of VTSAX can result in slightly higher returns over time.

This is average annual return over the trailing period for both the funds:

| Period | VTSAX Return | VTSMX Return |

|---|---|---|

| 1-Year | -8.12% | -8.12% |

| 3-Year | 18.35% | 18.23% |

| 5-Year | 10.36% | 10.24% |

| 10-Year | 11.68% | 11.56% |

Note: The above table represents hypothetical returns for illustration purposes only. Past performance is not a guarantee of future results.

Both VTSAX and VTSMX has given similar returns over trailing 5-years period. As you can see there’s little difference and what fund you choose to invest in depends on your investment style and upfront investment capital available.

Choosing the Right Fund for Your Portfolio

Deciding between VTSAX and VTSMX depends on your individual circumstances, investment goals, and available capital. Here are some factors to consider when choosing the right fund for your portfolio:

- Minimum Investment: If you have at least $3,000 to invest, VTSAX may be a better option due to its lower expense ratio. However, if you have less than $3,000 to invest, VTSMX is still a solid choice for gaining broad market exposure with a relatively low expense ratio.

- Expense Ratio: If minimizing costs is a top priority, VTSAX’s lower expense ratio may make it the more attractive option over the long term.

- Investment Goals: Both VTSAX and VTSMX provide diversified exposure to the U.S. stock market, making them suitable for long-term investors seeking capital appreciation. If your investment goals align with this objective, either fund could be a good fit.

Keep in mind that if you start with VTSMX and later accumulate at least $3,000 in the fund, you can convert your Investor Shares to Admiral Shares (VTSAX) without incurring any tax consequences or fees.

Finally Both Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) and Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) offer investors diversified exposure to the U.S. stock market at a low cost. Remember that funds like VTSAX and VTSMX have become popular for a reason: they provide a simple, low-cost way to gain exposure to the entire U.S. stock market, which has historically been a significant driver of wealth creation.

No matter which fund you choose Index funds, ETFs or Mutual Funds, the key to long-term success is staying consistent with your investment strategy, regularly reviewing your portfolio, and maintaining a long-term perspective. As pop culture icon Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” By keeping these principles in mind and staying disciplined in your approach, you’ll be well on your way to achieving your investment goals.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult a financial advisor before making any investment decisions. Past performance is not a guarantee of future results.

[…] a mix of asset classes: Invest in a variety of asset classes, such as domestic and international stocks, bonds, and cash, to create a balanced […]